thE FUND MANAGEMENT OS

thE FUND MANAGEMENT OS[

X

]

[

docs

]

[

Linkedin

]

[

Telegram

]

[

Youtube

]

V.1

SOON

Docs

X

Telegram

Youtube

Linkedin

V.1

SOON

the FUND

MANAGEMENT

operating

system

MANAGEMENT

operating

system

Infrastructure for Internet Capital Markets

INFRASTRUCTURE

fully onchain.

Non-custodial. Frictionless.

Deterministic.

permissionless

dtfS

Deploy, Manage and Monetize Funds dtfS

fully onchain.

Non-custodial. Frictionless.

Deterministic.

STRUCTURED

One-Click Fund Creation

COMPOSABLE

FUNDS

FUNDS

Create diversified, tokenized portfolios

in clicks.

Define strategy, asset classes,

and Governance.

in clicks.

Define strategy, asset classes,

and Governance.

MARKET LAYER

fund managers

meet capital

meet capital

An open marketplace connecting strategy and liquidity.

The Operating System

where everyone plays by the same rules.

The Operating System

where everyone plays by the same rules.

An Evolving Infraestructure for all tokenized asset classes.

Focused Innovation

makes dfm unique

The Fund Logic Engine

Multi-Role Permissions

Fund managers, DAOs, auditors—each with defined access. No multisig theatre. Just clean, verifiable accountability.

Composable Strategies

Plug into integrated liquidity, Crypto, LSTs, Perps, RWAs, more.

Define once. Recompose infinitely across Solana’s execution layer.

Programmatic Fees & execution flows

Fees accrue transparently. Predictable, programmable, immutable. Revenue routes natively through smart logic, no intermediaries, no offchain drift.

The Fund Logic Engine

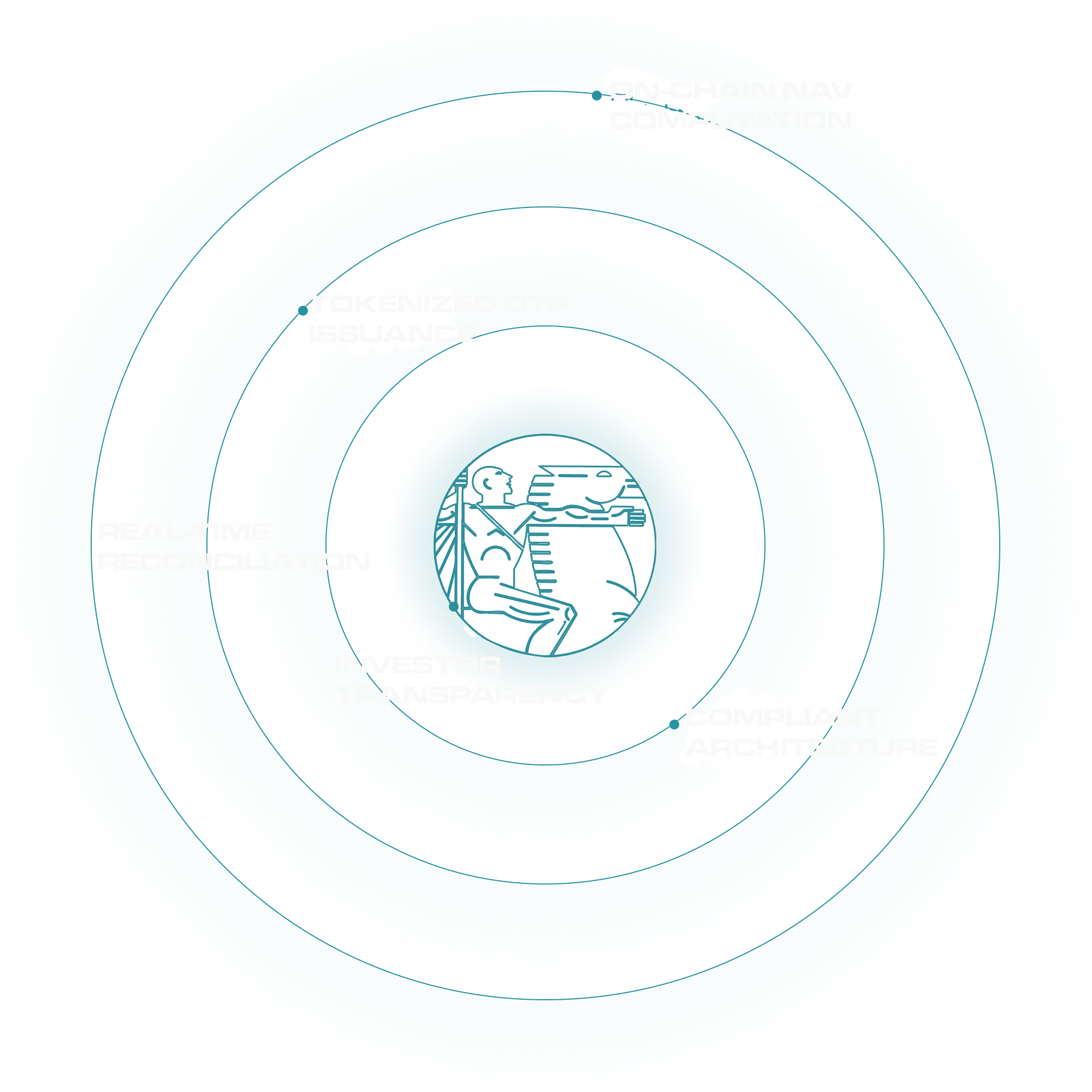

DEFI MARKETS ROAD MAP

Just like exchanges digitized trading, DFM transforms how funds are structured, launched, and scaled onchain.

The tide is turning

$30T+Projected tokenized Market opportunity by 2030

24/7Onchain

Market never sleeps

Market never sleeps

65%+Institutional investors already exploring digital assets

99.7%Accuracy in onchain NAV tracking vs. manual reconciliation

Features for more efficiency

Audited

All logic is onchain, code-audited. Transparency and trust built into every operation.

dtf-Based Asset Custody

Underlying assets secured in DTF contracts. Transparent, verifiable, and fully auditable.

Jupiter-Integrated Liquidity Flows

Deposit or redeem directly through Jupiter APIs. Seamless execution with cross-pool routing and minimal slippage.

Compliant Architecture

Onchain fund logic mapped to global compliance standards. Every operation traceable and auditable in alignment with MiCA, IFRS, and GAAP standards.

Programmatic Fees

Accrue transparently onchain. Predictable, verifiable, and built into fund logic.

Governance-Defined Rebalancing

Flexible governance modules define fund reallocation. Fund Managers, Fully programmable, DAOs or Futarchy

DFM v.1

DAOs, KOLs, Alpha callers, Launchpads. Crypto, Perps, Stablecoins, LSTs, RWA.

Fund managers, DAOs, auditors—each with defined access.

Fund managers, DAOs, auditors—each with defined access.

Permissionless DTFs

Open DeFi & Creator Economy

Fund managers

DFM v.2

Regulated & KYC Markets

Licensed managers, Regulated issuers, Qualified investors Tokenized treasuries, Credit funds, Institutional RWAs.

Sarah L.

Regulated & KYC Markets

Licensed managers

A game changer for managing my crypto. Easy to use, secure, and perfect for everyday transactions.

John M.

Crypto Investor

Performance meets precision. Every detail engineered for impact.

Material Composition

Advanced lightweight synthetics with adaptive stretch

Fit AND Feel

Tailored silhouette with unrestricted movement

Durability

Reinforced stitching and abrasion-resistant build

Weight

Ultra-light design optimized for all-day wear

Functionality

Responsive structure with moisture-wicking properties

Care

Easy-clean, fade-resistant surface

roadmap

DFM v.1

Permissionless DTFs

Fund managers, DAOs, KOLs, Alpha callers, Launchpads.

Assets: Crypto, Perps, Stablecoins, LSTs, RWA.

Assets: Crypto, Perps, Stablecoins, LSTs, RWA.

DFM v.2

Permissioned DTFs

KYC'd investors and regulated issuers.

Assets: Tokenized treasuries, Yield funds, ETF-style portfolios

Assets: Tokenized treasuries, Yield funds, ETF-style portfolios

DFM v.3

Institutional CDOs

Asset managers, Hedge funds, allocators.

Assets: Institutional debt, structured products, CDOs.

Assets: Institutional debt, structured products, CDOs.

READY TO RESHAPE FINANCE?

JOIN THE WAITLIST

DECENTRALIZED FINANCIAL MARKETS